We estimate how much of the impact from the Fed’s current tightening cycle is yet to be felt in the U.S. economy in both absolute and relative terms. To do this, we use the model from D’Amico and King (2023), which explicitly incorporates economic expectations and allows for forward guidance. 1 That model implies larger effects of monetary policy and faster policy transmission than other empirical models. We estimate that although the majority of the effects on output and inflation have already occurred, the policy tightening that has already been implemented will exert further restraint in the quarters ahead, amounting to downward pressure of about 3 percentage points on the level of real gross domestic product (GDP) and 2.5 percentage points on the Consumer Price Index (CPI) level. Tightening effects on the labor market manifest more slowly, so more than half the policy impact on total hours worked is yet to come. According to the model’s forecast, the policy tightening that’s already been done is sufficient to bring inflation back near the Fed’s target by the middle of 2024 while avoiding a recession. 2

The Federal Open Market Committee (FOMC) has raised short-term interest rates over 500 basis points since early last year, but it recently slowed the pace of policy tightening and some participants have signaled that the current tightening cycle might be nearing its end. 3 In making the decision to stop raising rates, an important consideration will be the extent to which the actions already taken by the Committee have yet to feed through to the economy. On the one hand, if substantial effects of past policy tightening are yet to come, that would argue for an earlier end to rate increases, all else being equal. On the other hand, if we have already seen in the data the bulk of the policy tightening’s effects, the additional restraint that is yet to be realized might not be sufficient to meet the FOMC’s inflation goal; in this case, policymakers may see the need to take further action.

One reason to think that the majority of the effects of the recent tightening have materialized quickly—perhaps more quickly than in the past—is that throughout this cycle the public has formed expectations for tighter policy well in advance of actual changes in the policy rate. Indeed, the FOMC itself helped shape these expectations through statement language, the Summary of Economic Projections, and other types of forward guidance. Do such changes in rate expectations effectively give actual policy rate changes a head start, so that we observe their consequences materializing faster? And does monetary policy have different effects on the economy when it is anticipated than when it is a surprise?

According to the vector autoregression (VAR) model developed in D’Amico and King (2023), the answer to both questions is yes. That model explicitly accounts for measures of expectations and for shocks to the current and expected policy rate; hence, it is better equipped than traditional VARs to capture the “expectations channel” of monetary policy, which results in larger and faster estimated effects on the economy. This is the channel through which expected changes in the policy rate feed back into the current state of the economy by affecting longer-term private credit costs (e.g., mortgage rates and car loan rates) and expected future prices and incomes.

In this Chicago Fed Letter , we use that model to estimate the speed and size of the transmission of the expected and unexpected policy tightening that has been implemented since March 2022, including the effects that have yet to occur. We do indeed find that about two-thirds of the tightening effect on the level of real GDP and three-quarters of the tightening effect on the CPI level have already happened. However, for two reasons, these results do not necessarily suggest that further tightening is warranted. First, in absolute terms the restraint that is yet to hit the economy is substantial. Second, the model forecast, which embeds the current monetary policy stance as well as other forces in the economy, indicates that inflation will return to near the Fed’s target by mid-2024.

We use the survey-augmented VAR of D’Amico and King (2023) to evaluate the effects of the current tightening cycle on output and inflation—both the effects that have already occurred and what is left to come. To do so, we estimate the difference between what happened (the data) and a counterfactual world where the policy rate had stayed at the effective lower bound (ELB), i.e., near zero in nominal terms, through 2023:Q3 and then project the difference forward.

The baseline VAR specification includes the three-month U.S. Treasury bill (T-bill) rate as a measure of the current policy rate, real GDP, CPI, total hours worked in the economy, the two-year nominal U.S. Treasury yield, and stock market returns (FT Wilshire 5000 Index) at a quarterly frequency over the period 1983:Q1–2023:Q3; 4 the model also includes measures of one-year expectations of real GDP, CPI, and the three-month T-bill rate from the Blue Chip Economic Indicators . 5

The use of all three Blue Chip variables allows us to identify two types of monetary policy shocks: a shock to the current policy rate and a shock to the expected policy rate (that does not move the current rate). Both types of shocks are separated from endogenous revisions to agents’ rate expectations that are driven by revisions in the economic outlook (also known as the “Fed information effect”). 6 Another important feature is that this VAR allows for all three measures of expectations (i.e., the three Blue Chip variables) to respond to both types of monetary policy shocks and for these expectations to feed back into the current state of the economy—what we in D’Amico and King (2023) call the expectations channel of monetary policy. Thus, our survey-augmented VAR tends to estimate that monetary policy has faster and larger effects on both real GDP and inflation than typically estimated with more traditional monetary VARs, which do not contain expectations variables. Such models do not have an independent role for forward-looking behavior, and identify policy shocks that are not exogenous to the Fed information effect.

We use the D’Amico and King (2023) model to construct a stark counterfactual exercise in which the realized and forecasted data are compared with the evolution of an economy in which the three-month T-bill rate (as a measure of the current policy rate) was kept unchanged at its ELB from 2021:Q4 through 2023:Q3. This is done by introducing a series of expected and current policy easing (negative) shocks that undo the observed tightening, given the estimated values of all other shocks that hit the economy during that time. 7 Figure 1 reports the series of counterfactual expected (orange) and current (black) policy rate shocks—with medians depicted as solid lines and shaded regions showing interquartile ranges based on the uncertainty associated with our estimates. It is interesting to note that shocks to the expected policy rate were larger at the early stage of the tightening cycle.

In figure 2 we show the differences between the actual and counterfactual economies and project these differences forward. Hence, the patterns depicted in panels A through H of figure 2 capture the effects of the monetary policy tightening implemented already, with the solid lines depicting the median impacts that have already occurred and the dashed lines depicting the median impacts that are yet to come. For real GDP, CPI, and hours worked, we also show the results in terms of growth rates (panels D, F, and H of figure 2). (We provide the conversion from levels into growth rates as such conversion is not immediate: The median of the changes is different from the changes in the median.)

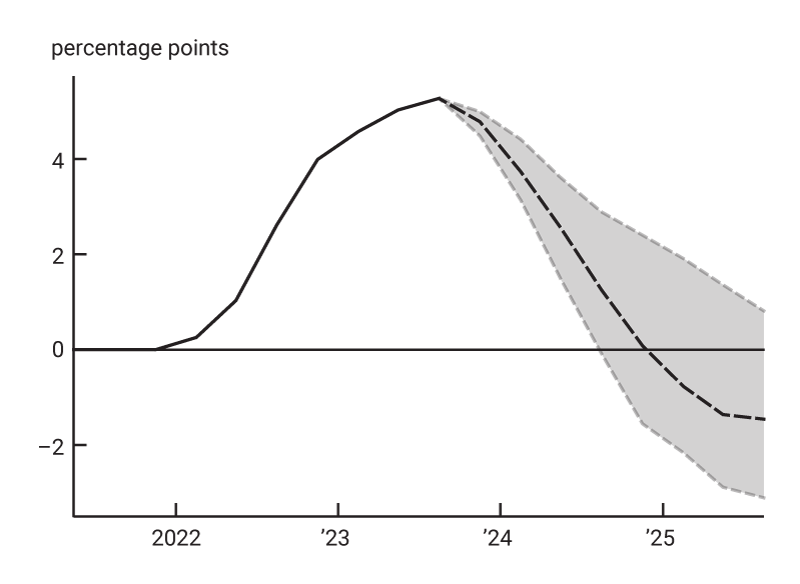

In response to the monetary policy tightening that has increased the actual three-month T-bill rate by about 530 basis points (panel A of figure 2), the one-year expected T-bill rate has increased by about 470 basis points (panel B) and the two-year nominal Treasury yield (not shown in figure 2) by about 500 basis points, almost one for one with the T-bill rate. As a result, real GDP and CPI (panels C and E) have already been substantially lower than they would have been without policy tightening: The median effects accumulate to a decline of 5.4 percentage points in the level of real GDP and a decline of 7.1 percentage points in the CPI level. These values respectively amount to about 65% and 75% of the total tightening effect on the levels of real GDP and CPI that will ultimately occur according to the model. The labor market is somewhat slower to respond to policy. Policy tightening has so far reduced hours worked by about 4 percentage points, or about 40% of the total effect it is projected to eventually have (panel G).

Importantly, the remaining 35%, 25%, and 60% of the total impact on the levels of real GDP, CPI, and hours worked, respectively, imply that past monetary policy tightening will exert further downward pressure of about 3 percentage points on real GDP over the next five quarters, 2.5 percentage points on the CPI over the next four quarters, and 6 percentage points on hours worked over the next eight quarters (figure 2, panels C, E, and G). The lags of the effects on CPI in our model are considerably shorter than what is typically obtained in more traditional VARs, partly because of the faster transmission of monetary policy and the absence of a “price puzzle” in our estimates. 8 Thus, the remaining decline in prices concludes much sooner than many models would predict.

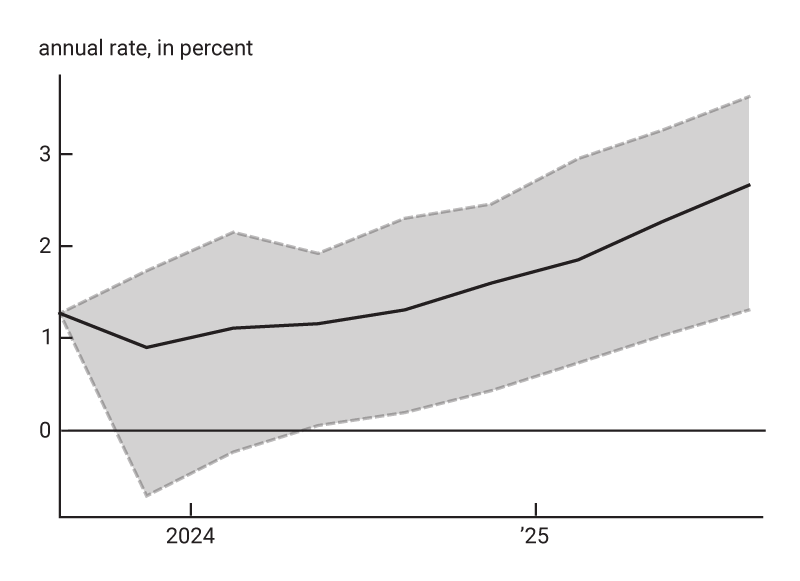

The survey-augmented VAR suggests that the effects of the past tightening on inflation have almost run their course; however, as shown in panel B of figure 3, the VAR forecasts that headline CPI inflation will fall below 2.3% by the middle of 2024. This 2.3% rate of CPI inflation historically translates into around a 2% rate of inflation according to the Personal Consumption Expenditures (PCE) Price Index, suggesting that the FOMC’s target (which is measured in terms of the PCE index) would be approximately met by then. 9 The abatement of inflation occurs without a recession, as real GDP growth remains in positive territory throughout the projection (figure 3, panel A), although the model does forecast a significant slowdown in hours worked (not shown in figure 3). As a result, the model predicts that the three-month T-bill rate should be unchanged for the rest of the year before starting to gradually decline in 2024 (not shown in figure 3). Unlike the counterfactual exercise shown in figure 2, these forecasts do not isolate the effects of monetary policy. However, it is important to note that there are wide uncertainty bands around the forecasts.

We note that the faster policy transmission in the survey-augmented VAR of D’Amico and King (2023) relies on a strong expectations channel of monetary policy; expectations start changing and therefore have economic effects before actual changes in the policy rate are implemented. A shift in policymaking over time that puts more emphasis on the expected policy path, such as a heavier reliance on explicit forward guidance, may have made the expectations channel more important and thus shortened the apparent lags of transmission. Furthermore, we find shocks to the expected policy rate to be larger at the early stage of the tightening cycle, so that their largest effects have by now dissipated. However, a strong expectations channel also means a more powerful monetary policy, so the estimated effects not only occur faster but also are bigger than typically estimated. This implies that the effects that are yet to come may still be big enough to bring inflation near target reasonably quickly.

1 Stefania D’Amico and Thomas B. King, 2023, “What does anticipated monetary policy do?,” Journal of Monetary Economics , Vol. 138, September, pp. 123–139. Crossref

2 The Federal Reserve’s inflation target, as measured by the annual change in the Personal Consumption Expenditures (PCE) Price Index, is 2% over the longer run, as reaffirmed by the Federal Open Market Committee (FOMC) in its annual statement on longer-run goals and monetary policy strategy. However, in this article, we focus on the CPI as the measure of inflation because the D’Amico and King (2023) model uses the one-year expectation for CPI from the Blue Chip Economic Indicators to help identify monetary policy shocks. We later provide the reading of CPI inflation that historically translates to 2% PCE inflation as we discuss our model’s projection for when inflation should reach the Fed’s target.

3 For instance, in figure 2 of the June 14, 2023, Summary of Economic Projections, two FOMC participants indicated no further rate hikes this year, while one saw additional rate hikes totaling one full percentage point.

4 Our data for 2023:Q3 consist of averages of daily financial market data through the end of July 2023 and forecasts from the July 2023 Blue Chip Economic Indicators published by Wolters Kluwer, which we obtain from Haver Analytics. For 2023:Q3 real GDP and CPI, we use the “nowcasts” from the July 2023 Blue Chip Economic Indicators .

5 All the data are obtained from the St. Louis Fed’s FRED (Federal Reserve Economic Data) database and Wolters Kluwer’s Blue Chip Economic Indicators (see note 4); and all variables except for the interest rates and their expectations are in log levels.

6 This is done by imposing the following sign restrictions in the VAR to identify both types of monetary policy shocks: The expected interest rate must move in the opposite direction of expected GDP and expected inflation. This pattern of changes in expectations is unique to the anticipation of exogenous monetary policy innovations in theoretical models, such as New Keynesian models. Our anticipated shocks impose the further restriction that the current interest rate does not respond in the period when the shock occurs.

7 The series of shocks includes an expected shock in 2021:Q4 that allows policy expectations to move and to begin to have economic effects in advance of the first change in the actual policy rate. We choose the sizes of the counterfactual policy shocks to be as small as possible—i.e., the most likely sequence of shocks that could have generated an unchanged interest rate path, conditional on other economic developments—and we do not impose any particular restriction on the counterfactual path of the expected policy rate.

8 The price puzzle is the phenomenon where inflation measures in some empirical models respond to monetary policy shocks in the direction opposite of what is predicted by theory for a few quarters before they start moving in the predicted direction.

9 An important caveat to our results, however, is that headline CPI, which is the inflation measure in the model, could depart from its historical relationship with PCE inflation—particularly, core PCE inflation, which has remained more stubbornly elevated lately. (Core inflation strips out the volatile food and energy price components of an inflation measure, such as the CPI or PCE index.)