Everything you need to know about Client Accounting Services (CAS), including strategies for growing your CAS delivery.

Client Accounting Services (CAS or CAAS) refers to a wide range of compliance and advisory services an accounting firm provides to a business client. Essentially, the accounting firm acts as an outsourced finance department for the client.

Business owners are actively looking for ways to achieve more growth with less work, time, and workforce. And an increasingly popular way they’re doing that is by outsourcing their accounting department to their accountant via client accounting services (CAS).

CAS does more than grow the business receiving the service—it can be very profitable for accounting firms providing the service. According to a survey from Accounting Today, 80% of firms that offer client accounting services report that it ‘provides superior revenue growth’, while 90% cite improvements in client satisfaction.

It’s one of the ways growth-focused firms are embedding themselves as their clients’ trusted advisor.

In this guide, you’ll learn how to build, scale, and position your firm’s CAS model.

Think of Client Accounting Services (CAS) as a level above traditional financial services and advisory.

CAS firms are outsourced to perform finance-as-a-service and do most, if not all, of the accounting and financial tasks for their clients.

You’ll also find CAS referred to as CAAS, Client Accounting Advisory Services, or Client Advisory Services.

Here are some of the key tiers of CAS:

Bookkeeping is a foundational tier of CAS.

By helping clients with the day-to-day recording of financial transactions, you create the building blocks of their financial records, aid in compliance, and provide the necessary data for strategic decision-making.

Offering bookkeeping through CAS involves many of the core financial services you’re already familiar with:

By offering bookkeeping under CAS, you give clients peace of mind and free them to focus on their core business activities.

Audits and tax preparation are traditional services, but they remain integral to comprehensive CAS offerings.

Audits involve examining a company's financial statements and records to ensure accuracy and compliance with accounting standards and regulations. Additionally, tax preparation involves compiling and filing tax returns, ensuring accuracy to avoid penalties, and advising on tax-efficient strategies.

A key reason why clients will opt for CAS over traditional accounting services is for the strategic guidance from their accounting partners.

CAS encompasses a range of advisory services that leverage financial data to provide strategic business advice. These services include helping businesses plan for growth, forecasting, optimizing operations, tax planning, and navigating complex financial challenges.

Many CAS models offer virtual controller services, where the accounting firm essentially provides outsourced CFO services.

This might include overseeing the production of financial reports—such as balance sheets and profit and loss statements—predictive modeling, managing budgets, and ensuring compliance with financial regulations and reporting standards.

Wealth management services are targeted at high-net-worth individuals or businesses with complex financial needs.

These services include offering advice on investment portfolios, providing insights on maximizing returns while managing risks, and assisting with retirement planning, including managing pensions and retirement savings. Estate planning is also a crucial part of wealth management, helping business owners manage, protect, and transfer their wealth effectively.

Traditionally, billing by the hour has been the go-to method in accounting. Firms calculate an hourly rate based on fixed costs and a targeted profit margin.

On paper, it’s a straightforward approach: you do the work, the clock ticks, the bill grows.

But this model is becoming increasingly outdated in today's accounting landscape. Technology is helping you be more efficient. The more efficient you are, the quicker you work, and the lower the bill.

Regardless of a service’s value to your clients, you’re capping your pricing based on how long it takes to deliver that service.

In a flat-rate pricing model, firms charge a set fee for a specific service.

Think of it like a fixed-price menu. For example, you would have separate prices for:

Unlike hourly billing, fixed-fee pricing allows you to increase profit as you increase efficiency—the more efficiently you can work, the greater the profit margin.

It's clear and predictable. Which can also be a shortcoming. By definition, fixed-fee pricing is inflexible, and in a complex industry, inflexibility can leave you vulnerable to scope creep and cost you money.

Value-based pricing sets rates based on the perceived value they have to your clients.

It’s similar to a fixed-priced model in that you charge differently depending on the service, but it’s not a one-size-fits-all approach.

It involves individual discussions with your clients to determine what their priorities are, what services they need, how often, and the scope of the projects. From there, you can weigh up all of these factors and give them a quote that accurately reflects the effort, time, and work required to meet their needs.

One of the biggest benefits of a value-based pricing model is the flexibility it offers. Unlike a fixed-pricing system, it allows you to adjust your fees according to individual asks and obstacles.

The subscription pricing model isn’t a subscription in a traditional sense, where you take your value pricing, divide it by 12 months of the year and engage clients on monthly retainers.

Instead, it lets you support your clients in any way they need. It’s full-service, which means there is no scope of work. Anything you can do to help your client, you do it. And when you can’t, you facilitate their relationship with a specialized service provider.

It’s a premium model: a premium level of service and a premium cost. It prices your relationship with your client, rather than inputs or outputs.

For example, you may charge a client $7,500 per month, which includes all the services you offer.

This model is a relatively modern pricing structure for the accounting profession, but it is gaining popularity—particularly among progressive firms.

You don’t need to stick to just one pricing model across all of your services.

Sometimes it may make more sense to charge a flat rate for basic services, hourly rates for additional time-consuming tasks, or value-based pricing for high-impact services.

Using a mixture of methods is a hybrid approach that offers flexibility and can be tailored to suit different types of clients and services.

CAS is a service offering that’s genuinely built for scale and growth. There are a number of strategies you can use to get a successful CAS model off of the ground.

Like with anything in life, good things take time.

So when it comes to building out your CAS firm, steady, sustainable growth is the name of the game.

Start with a basic tier of client accounting services: transactional and write-up offerings. This includes services like:

As you grow, you can start to gradually move towards offering more advisory services, including strategic planning sessions, financial health assessments, or tax planning advice.

Finding a niche will enable you to become an expert in a specific industry or with a particular group of clients. You’ll have a deep understanding of their unique challenges and opportunities, making you a perfect strategic advisor.

This will help you attract specific businesses, scale your CAS model, and charge more for your expertise.

Resources like the American Institute of Certified Public Accountants (AICPA) can be invaluable for firms looking to develop or expand their CAS offering.

AICPA offers educational materials, best practice guides, tools for implementing and managing CAS, even CAS certification courses.

Leveraging these resources can help firms:

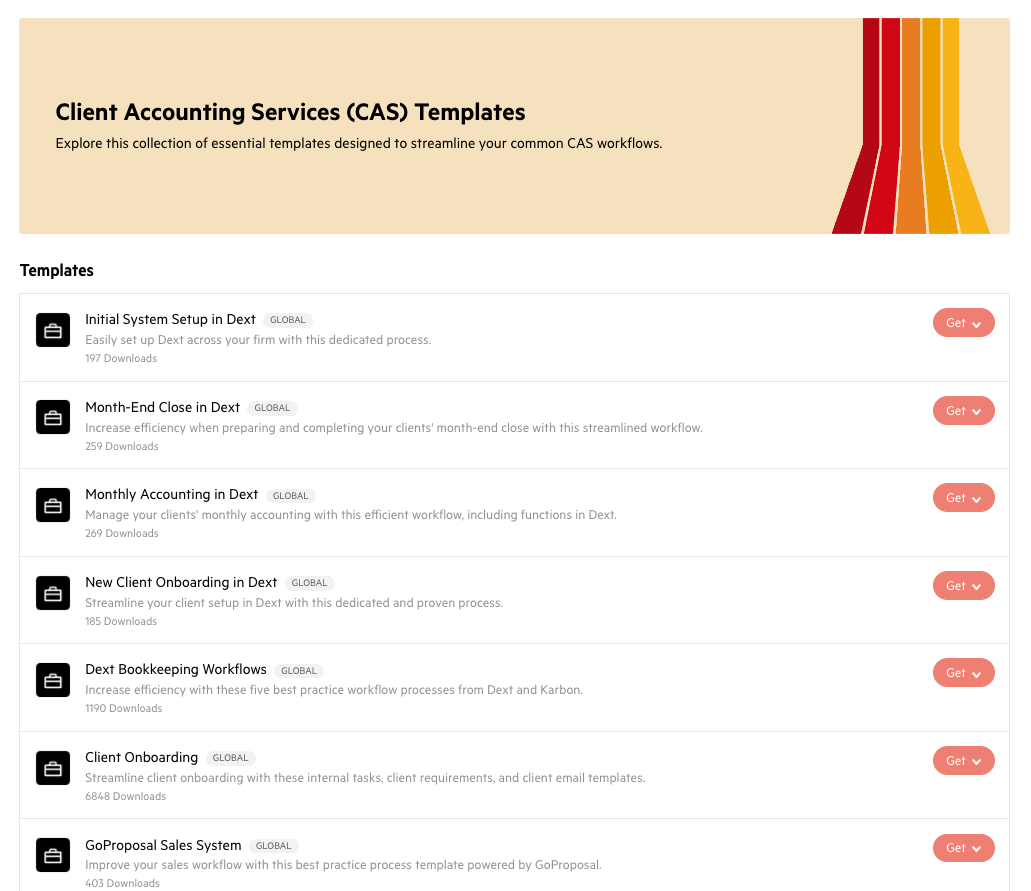

You can also leverage the Karbon Template Library, which includes a specific collection of CAS workflow templates. These templates are designed to streamline your common CAS workflows.

You can download these templates as Excel spreadsheets or use them directly in your Karbon account. Either way, they’re completely customizable to suit your firm.

Scaling an effective CAS program means adopting the right technology to help you do it.

Automation tools represent a fundamental, positive shift in the way financial data is processed, analyzed, and reported. Studies show that 77% of all general accounting operations can now be fully automated with the right accounting software.

Today, accounting technology can help you automate tasks, data entry, report generation, and even some aspects of analysis, which significantly enhances efficiency, accuracy, and the speed of service delivery.

It frees up time for accountants to focus on people-first services like advisory while also improving client satisfaction with quicker turnaround times and reduced error rates.

A comprehensive offering like CAS necessitates a comprehensive accounting technology stack.

Accounting practice management software like Karbon should be at the core of yours. These tools are purpose-built to handle multiple clients across multiple verticals efficiently, with automated workflows, specialized client management tools, and AI features.

Firms like CRC are doing just that:

There are key features of accounting practice management software that dramatically increase the effectiveness of any CAS offering:

Book a Karbon demo or start a free trial to learn how scaling client accounting services is possible with world class accounting practice management.

The primary goal of client accounting services is to provide comprehensive financial support to clients—support that goes beyond traditional accounting and bookkeeping.

It aims to offer strategic financial insights, assist in decision-making, and help clients improve their overall financial health and business performance. This includes services like financial planning, tax advice, budgeting, and business advisory, all designed to help clients achieve financial stability, growth, and long-term success.

CAS focuses on close-knit and ongoing collaboration between clients and accounting professionals. The process often involves:

An accounting firm has several key duties to its clients, especially when it comes to CAS.

They need to ensure they are:

In essence, offering outsourced accounting services is all about establishing a trusted, advisory relationship where firms actively contribute to the client's financial success and stability.

Elevate your client accounting services to new heights, solidify your reputation in the industry, and unlock greater profitability with Karbon. Sign up today.